Trump and Softbank Are Just ‘Noise’ for Intel. Here’s How Wall Street Really Thinks You Should Play INTC Stock.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Wall Street isn't buying the headlines surrounding Intel's (INTC) recent high-profile backing from the Trump administration and SoftBank (SFTBY). In the past week, the U.S. government converted $8.9 billion in CHIPS Act funding for Intel stock into a 10% equity stake, while SoftBank invested $2 billion in the chipmaker. However, Bank of America maintains that these moves are essentially "noise" that won't solve Intel's fundamental problems.

BofA analyst sees both positives and "likely pitfalls" in the government's non-voting equity position, while calling SoftBank's investment "more promising but not a game-changer." The firm argues that neither government intervention nor new investors will help Intel close critical gaps: its manufacturing disadvantage against Taiwan Semiconductor (TSM), its artificial intelligence (AI) portfolio shortfall versus GPU leaders like Nvidia (NVDA), or its CPU market share losses to AMD (AMD) and ARM-based competitors.

The core issue remains Intel's manufacturing competitiveness. For instance, the foundry business has yet to secure a major customer, and its Ohio factory complex won't begin operations until 2030.

With Intel stock losing 64% of its value last year before recovering 20% so far in 2025, BofA maintains its “Neutral” rating and $25 price target, suggesting INTC stock will remain range-bound until the chipmaker demonstrates real manufacturing progress against industry leaders.

Is INTC Stock a Good Buy Right Now?

INTC stock presents a compelling turnaround opportunity under new CEO Lip-Bu Tan's strategic leadership. It is an attractive stock for patient investors willing to bet on one of technology's most dramatic corporate transformations.

The semiconductor giant delivered revenue of $12.9 billion in Q2, exceeding guidance expectations despite ongoing challenges. Over the past year, Intel has made decisive moves to streamline operations, reducing management layers by 50% and targeting 75,000 employees by year-end while cutting operating expenses from $17 billion in 2025 to $16 billion in 2026. This operational discipline extends to capital allocation, where Intel has already reduced capital expenditure guidance by $5 billion year-to-date (YTD) and plans further reductions in 2026.

The foundry strategy is rebuilt on pragmatic foundations rather than speculative capacity expansion. Intel's 18A technology node is progressing steadily toward yield and performance targets, with Panther Lake set to launch by year-end. This process node will serve as the foundation for at least three generations of Intel products, which provides internal volume validation before attracting external customers. The company is taking a disciplined "show me the money" approach, requiring customer volume commitments before deploying additional capital.

Intel's core x86 franchise remains resilient, with continued strength in client PCs driven by Windows 10 end-of-service and AI-equipped PC adoption. The server business, while facing competitive pressures, maintains a 55% market share and is benefiting from enterprise refresh cycles and AI infrastructure demand.

Financial flexibility is improving through strategic asset monetization, including $900 million raised from Mobileye's partial sale and the pending Altera transaction. With $21.2 billion in cash and short-term investments, Intel maintains sufficient liquidity to execute its turnaround plan while working toward positive free cash flow (FCF) generation for the first time since 2021.

What Is the INTC Stock Price Target?

Intel is forecast to increase sales from $52 billion in 2025 to $65.6 billion in 2029. In this period, its adjusted earnings are forecast to expand from $0.12 per share to $2.76 per share. Moreover, the chip giant is projected to end 2029 with a FCF of $15.3 billion, compared to an outflow of $10 billion this year.

If INTC stock is priced at 21x forward earnings, which is in line with its 10-year average, it should trade around $55 in early 2029, indicating an upside potential of over 100% from current levels.

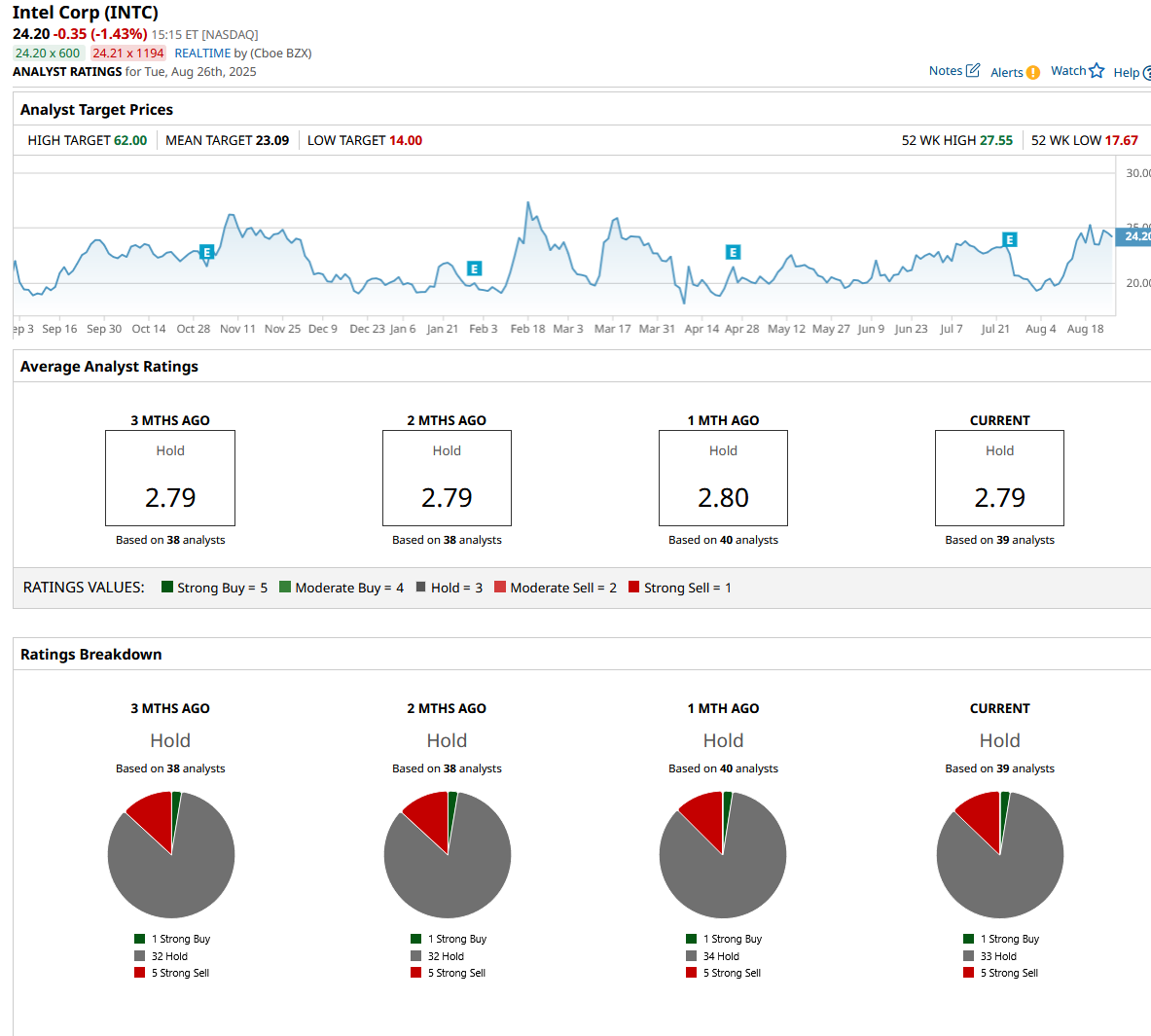

Out of the 39 analysts covering INTC, one recommends “Strong Buy,” 33 recommend “Hold,” and five recommend “Strong Sell.” The average INTC stock price target is $23, below the current price of $24.20.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.