Billionaires Are Buying Up This Chip Stock (Hint: It’s Not Nvidia)

Billionaires are quietly crowding into a different artificial intelligence (AI) winner, and it’s not Nvidia (NVDA). The latest round of 13F filings revealed that legendary billionaire investors like David Tepper, Stanley Druckenmiller, and George Soros have all been quietly increasing their stakes in Taiwan Semiconductor Manufacturing (TSM).

While Nvidia has dominated the AI conversation, with eye-popping returns and constant headlines, it’s actually TSM that plays the indispensable role behind the scenes. TSM manufactures the world’s most advanced chips that power Nvidia’s GPUs, Apple’s (AAPL) iPhones, and the servers fueling AI adoption.

The timing of this buying spree is no coincidence. With TSM delivering record-breaking earnings growth, the stock has surged 40% in the past year. Yet, its valuation still sits near sector averages, making it a compelling blend of growth and relative value that even the savviest hedge fund managers can’t seem to ignore. Let’s find out more on TSM.

TSM’s Record Earnings

Taiwan Semiconductor Manufacturing, the world’s leading contract chipmaker with a market capitalization of roughly $1.21 trillion, is the engine behind the GPUs, smartphones, and data-center processors. It pays an annual dividend of $2.13 per share, yielding 0.91%, underscoring its commitment to returning steady cash flow even amid aggressive expansion.

Year-to-date, TSM has climbed 20.43%, and over the past 52 weeks it’s surged 40.67%, closing most recently at $235.59.

On valuation metrics, the stock trades at forward earnings of 23.71x versus the sector median of 23.53x, while its PEG ratio of 1.11x compares favorably against the industry’s 1.88x, an indicator that growth expectations still outpace its price multiple.

In its July 17 earnings release for Q2, prepared under Taiwan Financial Supervisory Commission: International Financial Reporting Standards (TIFRS) on a consolidated basis, TSM announced revenue of NT$933.79 billion ($30.07 billion), up 38.6% year-over-year (YoY) and 11.3% sequentially, and net income of NT$398.27 billion ($13.14 billion), representing a 60.7% spike versus the prior year and a 10.2% uplift quarter-on-quarter (QoQ).

TSMC’s diluted earnings per share climbed sharply to NT$15.36 for the quarter, equivalent to US$2.47 per ADR, a substantial increase from US$1.54 per ADR in the same period last year. The company sustained impressive profitability metrics across the board, posting a gross margin of 58.6%, an operating margin of 49.6%, and a net profit margin of 42.7%, highlighting both its pricing power and disciplined cost management.

TSM’s Big Investments

The world’s largest contract chipmaker is making an astonishing investment of more than $100 billion in the United States, a decision that signals not only bold ambition but a strategic response to geopolitical and supply chain realities. This massive capital infusion will result in at least five new facilities, including three state-of-the-art chip fabrication plants, two advanced packaging centers, and a dedicated research and development hub.

TSM is also aggressively scaling up in Japan, with new manufacturing efforts focusing on advanced Complementary Metal-Oxide-Semiconductor sensors and automotive chips. In Kumamoto, the first Japanese fab is already operational, serving major automotive and tech clients.

Meanwhile, a second facility is preparing to break ground later this year, contingent on the completion of necessary infrastructure and regional logistics. This push will reinforce Japan’s role as a pivotal hub in TSM’s international supply chain and expand its reach into the fast-evolving automotive chip market.

Demonstrating that the bullish outlook isn't limited to hedge fund titans, public disclosures reveal that Congressman Cleo Fields recently purchased up to $500,000 worth of TSM stock, spread across two transactions in June and July 2025.

Analysts’ Nod of Approval

Analyst sentiment around Taiwan Semiconductor remains resolutely bullish as the company approaches its next earnings release, scheduled for Oct. 16, 2025. For the current quarter ending September, consensus forecasts point to earnings of $2.56 per share. That’s a sizable jump from $1.94 in the prior year’s period.

Looking ahead, the full-year 2025 earnings estimate has climbed to $9.83 per share, well ahead of last year’s $7.04, translating to expected YoY growth rates of 31.96% for the quarter and a remarkable 39.63% for the year.

TSM’s management has echoed this optimism, projecting third-quarter revenue will reach between $31.8 billion and $33.0 billion. Despite a rapidly expanding cost base tied to its $100 billion U.S. investment spree, gross profit margins are expected to remain impressively high, between 55.5% and 57.5%.

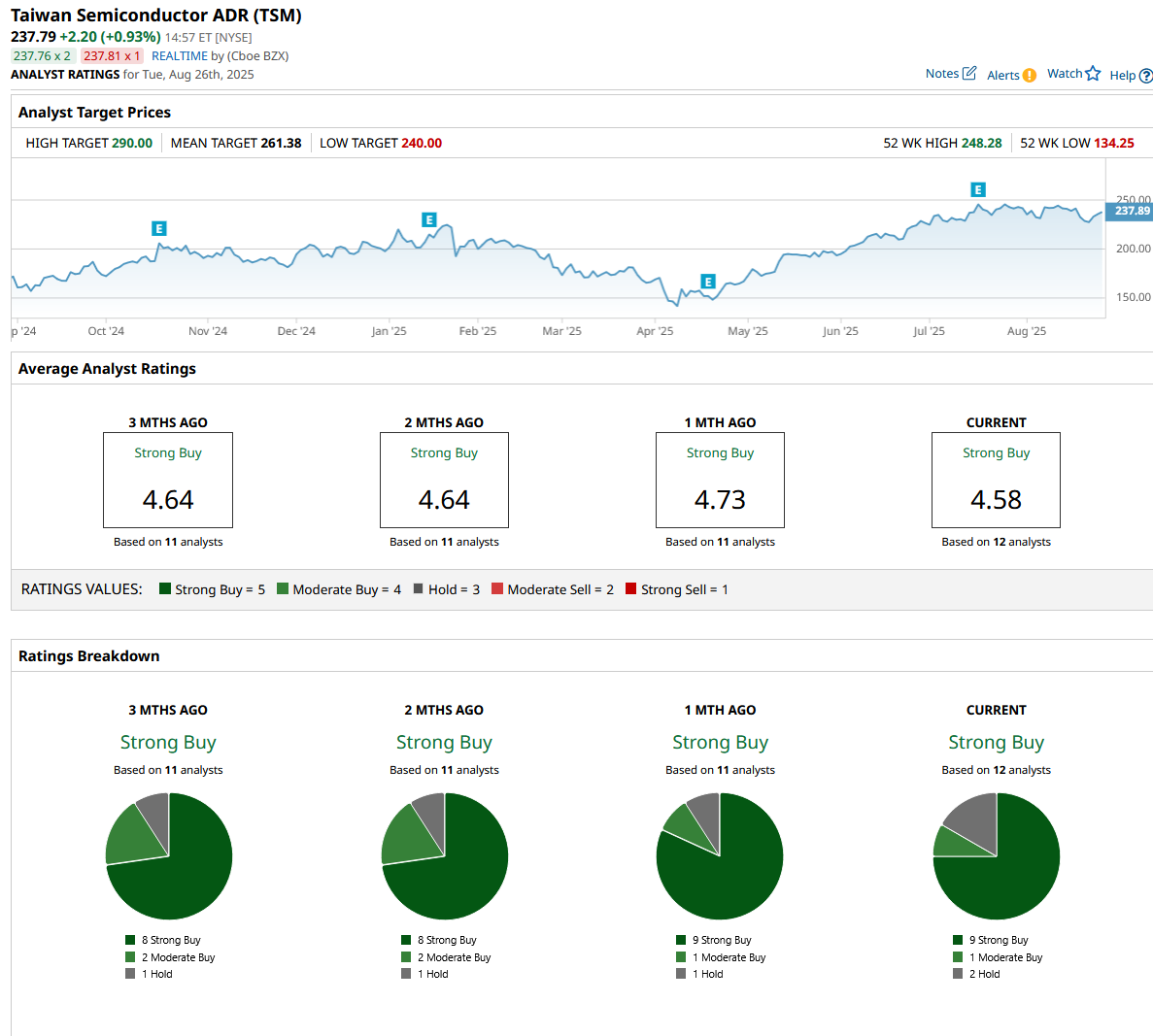

Turning to analyst recommendations, the consensus is pretty much as decisive as it gets, with a “Strong Buy” from nine out of the 12 analysts covering TSM. The mean price target sits at $261.38, which implies an upside of approximately 10.7% from the current price.

Conclusion

TSM is attracting confident bets for good reason. The company continues to deliver strong earnings and guidance, and analysts see even more room for shares to run, with a consensus target pointing to double-digit upside from here. With billionaires taking notice and the market’s fundamentals lined up, the stock looks set to push higher as demand for its chips stays hot. All signs suggest TSM still has runway ahead.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.