How Low Can Wheat Prices Go?

In my early July 2025 Barchart article on the grain and oilseed markets, I highlighted the bearish price action in the corn, wheat, and soybean markets, concluding with the following:

The leading grains and oilseeds- corn, wheat, and soybean futures are trading at low levels compared to the 2022 highs, but they also display a long-term, multi-decade pattern of higher lows. Population growth means that production must keep pace with the fundamental equations’ ever-expanding demand side for food. Moreover, the increasing demand for biofuel puts additional upward price pressure on the agricultural products. Therefore, I continue to believe that grain and oilseed futures have limited downside and the potential for explosive upside price action. While prices could move over as the 2025 crop year progresses, lower prices could be a buying opportunity for the coming years.

Nearby CBOT soft red winter wheat futures fell 1.54% in Q2 and were 4.13% lower over the first half of 2025, settling at $5.2875 per bushel on June 30, 2025. The KCBT hard red winter wheat futures fell 9.16% in Q2 and were down 9.52% over the first six months of this year, settling at $5.06 per bushel at the end of Q2. Meanwhile, the MGE spring wheat futures edged 1.68% higher in Q2 and were 1.22% higher from the end of 2024 through the end of Q2 2025, ending the second quarter at $6.03 per bushel. In late August 2025, the three nearby wheat futures were lower than they had been at the end of June.

Wheat prices move lower

CBOT soft red winter wheat futures tend to be the most liquid when compared to the KCBT and MGE futures.

The daily year-to-date chart of the CBOT wheat futures shows that the price dropped to a new 2025 low of $4.9450 per bushel on August 20. At the $5.1050 level on August 25, the wheat futures were 18.25 cents per bushel below the Q2 closing price.

On August 25, the September KCBT hard red winter wheat futures at $5.0125 were only 4.75 cents lower, and the September MGE spring wheat futures at $5.7175 were 31.25 cents per bushel below the June 30, 2025, settlement price.

The August WASDE report was bearish

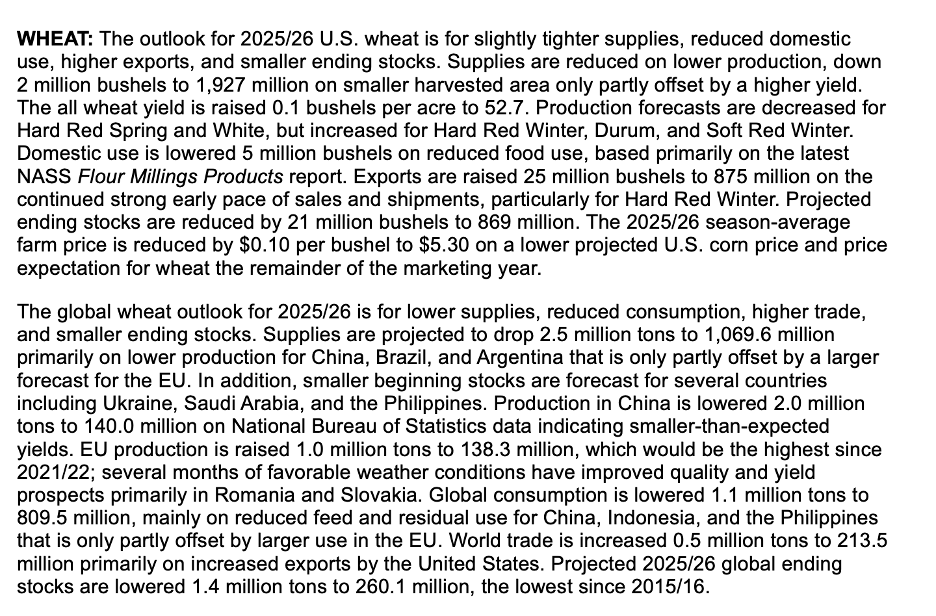

The U.S. Department of Agriculture released its August World Agricultural Supply and Demand Estimates Report on August 12. The report told the wheat market:

While U.S. and global ending wheat stocks declined from the previous month, the USDA lowered its price forecast for wheat. I reached out to Jake Hanley, the Managing Director at the Teucrium family of agricultural commodity ETF products, including the WEAT ETF. Jake’s take on the WASDE’s wheat comments was:

Wheat’s domestic situation remains heavy despite a small drop in U.S. ending stocks from stronger export demand. Globally, however, wheat stocks have fallen to their lowest level since 2015/16, a trend that could lend long-term support even if near-term U.S. supplies keep prices in check.

Wheat prices have moved lower and have not responded to the lowest level of global wheat inventories since 2015/2016.

Long-term charts suggest that the downside could be limited

While the short-term trends in the wheat futures market remain bearish, the CBOT soft red winter wheat futures may approach a compelling level in August 2025.

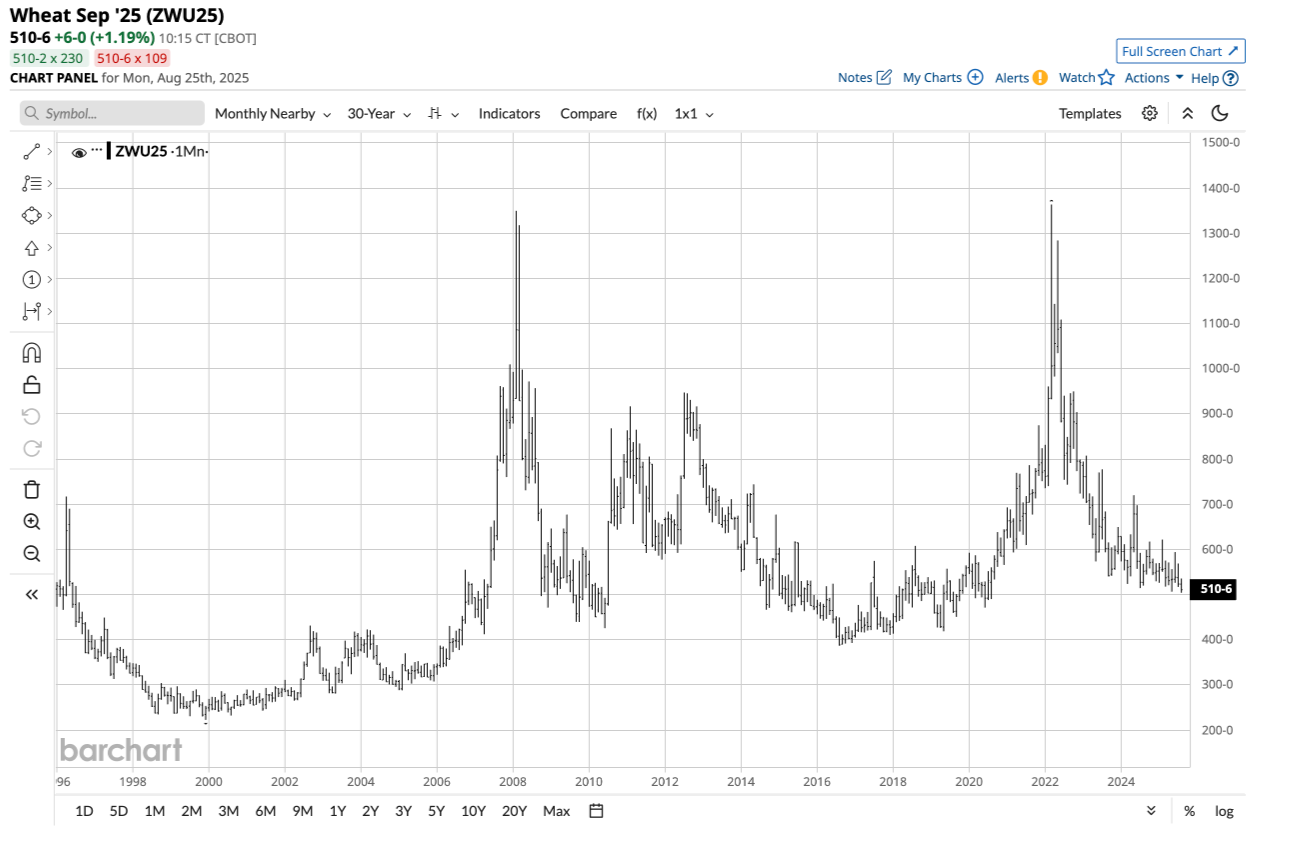

The thirty-year monthly CBOT wheat chart highlights that the futures have continued to slump in a bearish trend since reaching a record high of $13.6350 per bushel in March 2022, following Russia’s invasion of Ukraine. Since CBOT is a global benchmark for wheat prices and Russia and Ukraine are leading wheat-producing countries, the war had caused supply concerns, sending wheat prices soaring to an all-time high.

Technical support for the CBOT wheat futures is around the $5 per bushel level, with the futures sitting near that level in late August 2025.

Factors that could support wheat prices in 2026

The following factors could send wheat prices higher over the coming months and in 2026:

- The current price level suggests that wheat’s downside price potential could be limited, with far greater upside price potential.

- At the current price, wheat producers are not incentivized to increase production and could turn to other, more profitable crops in 2026.

- Global inventories at the lowest level in a decade suggest that while supplies are currently adequate to meet the worldwide demand, low inventories could create a price bottom over the coming months.

- Commodity cyclicality in wheat suggests that prices tend to decline to levels where production slows, inventories decline, and demand increases, resulting in significant price bottoms.

- Global inflationary pressures have increased production costs, which could support prices around the $5 per bushel level.

- Hostilities in Russia and Ukraine remain substantial factors for worldwide supplies.

Wheat prices are at a historically low level, presenting a compelling opportunity for next year.

WEAT is an ETF that tracks CBOT wheat futures

The most direct route for a risk or investment position in global wheat prices is the Chicago Mercantile Exchange CBOT division’s soft red winter wheat futures contracts.

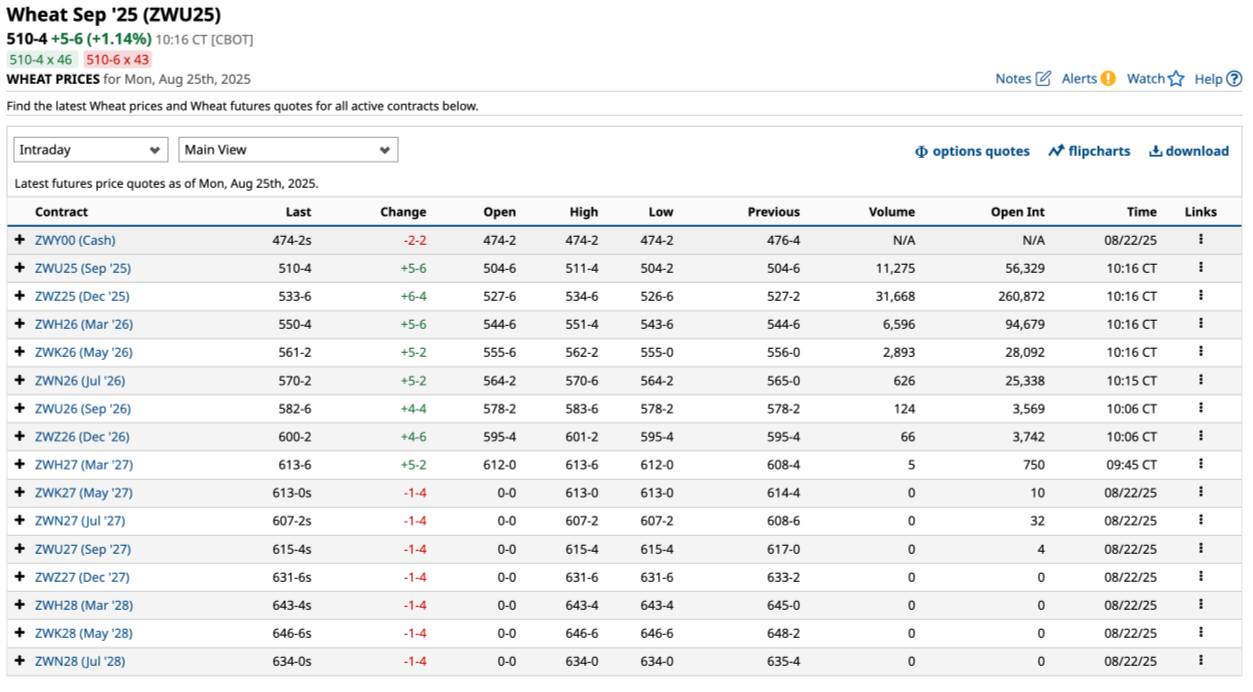

The forward curve for CBOT wheat futures highlights the contango, where deferred prices are higher than nearby prices, suggesting the influence of commodity cyclicality. The price for July 2026 delivery is nearly 60 cents per bushel higher than the September 2025 futures price, and the level for July 2027 delivery is over 96 cents higher, surpassing the $6 per bushel level.

While the futures are the route for the most direct exposure, the Teucrium Wheat ETF (WEAT) owns a portfolio of three liquid CBOT wheat futures, excluding the nearby contract, to minimize roll risks.

At $4.27 per share, WEAT had nearly $115 million in assets under management. WEAT trades an average of over 656,700 shares daily and charges a management fee of 0.83%.

If CBOT wheat futures are poised to recover in 2026, buying WEAT on a scale-down basis as the price flirts with the $5 per bushel and lower could be optimal for the coming year. There are no rules regarding how low wheat, or any commodity, can fall during a bearish trend. However, the lower the prices fall, the greater the odds of recovery based on commodity cyclicality.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.